Make ACA Compliance Easier—and Less Risky

Track Eligibility, Apply the Right Codes, and File With Confidence

Staying compliant with the Affordable Care Act isn’t just about year-end reporting. It’s a year-round challenge — from monitoring variable-hour employees to applying the right codes, providing 1095 forms, and avoiding costly penalties.

With more than 72,500 EINs filed and 1.2M employees tracked, Selerix helps you stay ahead of ACA requirements. Our tools simplify measurement, automate coding, and streamline filing and form provision. Whether you’re handling standard filings or complex workforce changes, we make ACA compliance more manageable and less stressful.

Why ACA Compliance Causes Headaches for HR

Common Challenges

- Manually tracking variable status and measurement periods.

- Confusion, lack of support, and guidance around ACA coding requirements.

- Limited visibility into compliance issues throughout the year.

- Risk of costly errors on 1095-C or 1094-C forms.

- Stressful year-end scramble to file accurately.

- Struggling with multi-EIN entities.

Compliance Wins

- Automated eligibility tracking and status updates.

- Built-in ACA coding logic and safeguards.

- Visibility into compliance status year-round.

- Streamlined IRS filing process.

- Peace of mind during the reporting season.

How Selerix Helps You Stay ACA Compliant

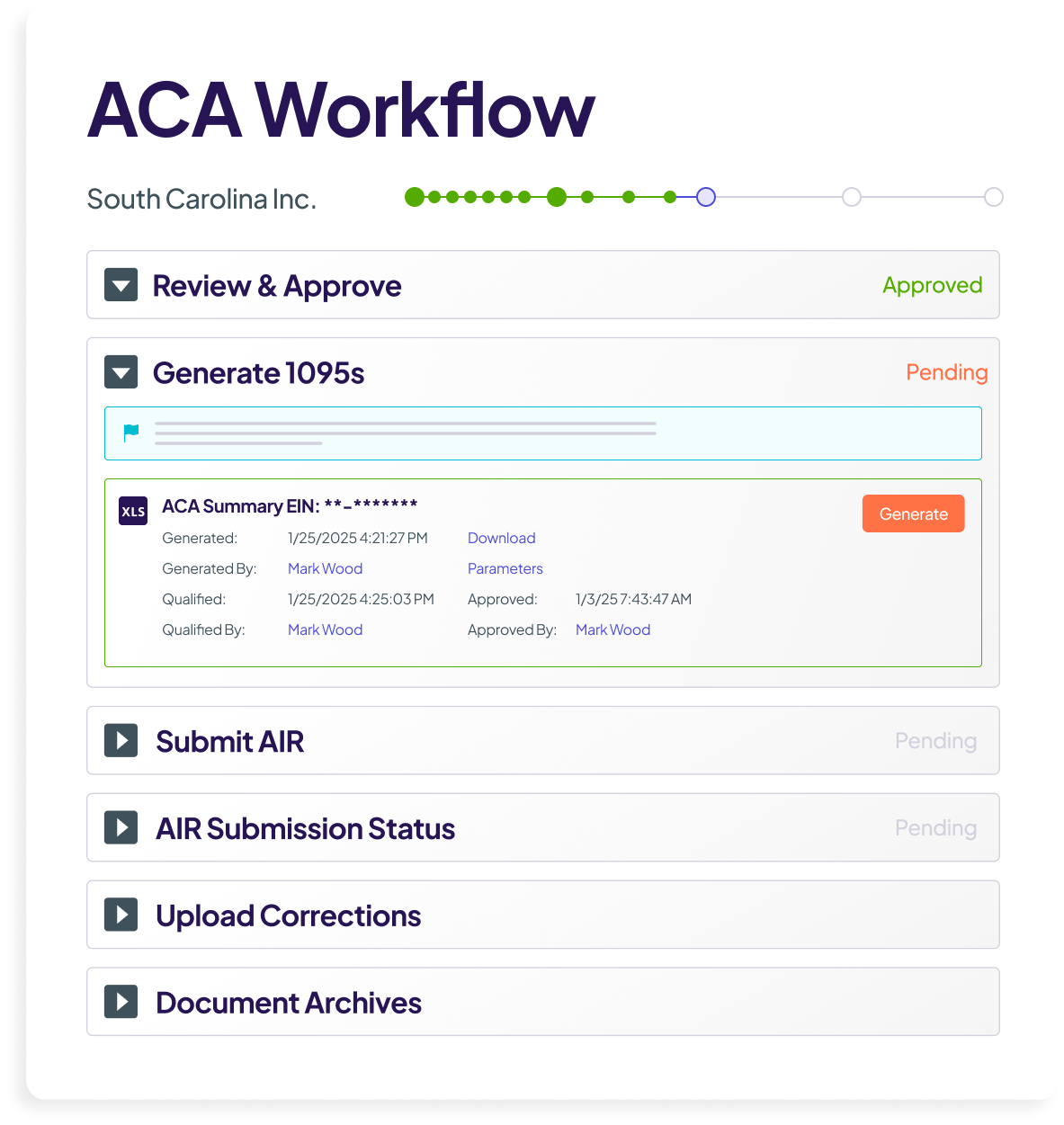

With Selerix, healthcare benefit compliance is built into your workflow — not an afterthought. We help you manage the entire process, from measurement tracking to electronic filing.

Healthcare Benefits Compliance

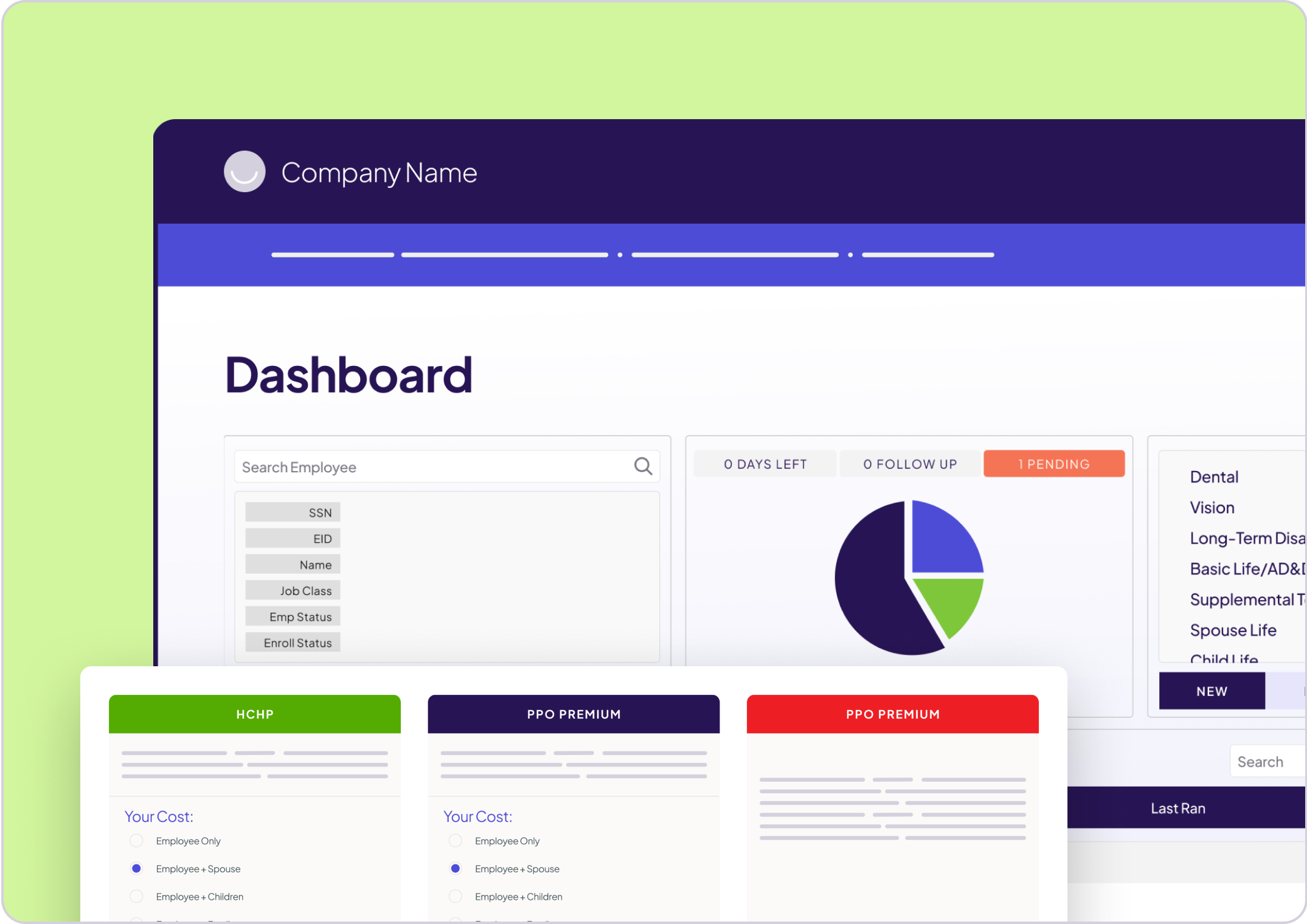

- Modular and self-service options to add to your HRIS stack.

- Automatically track measurement periods and full-time status.

- Apply correct Line 14, 15, and 16 codes based on real data.

- Identify compliance gaps before they become penalties.

- Generate and file accurate 1094/1095 forms.

BenSelect

- Integrated ACA support built in.

- Configure and enforce eligibility rules within your enrollment process.

- Ensure data accuracy upstream to support compliant reporting.

Real Support for Real Compliance Questions

When it comes to ACA and healthcare compliance, the details matter. Our support team understands the nuances of eligibility, coding, and IRS reporting. We have managed $650M in mitigated penalties, and we’re here to help you get it right.

From setup to submission, we offer guidance and expert help so you can file with confidence and focus on what matters most: your people.

Keep Clients Compliant – and Confident in You

ACA compliance is complex, and mistakes can cost your clients big. With Selerix, you can offer automated measurement, tracking, coding, and filing support — along with real human expertise — to lower risk, reduce calls, and reinforce your value as a trusted advisor