Boosting Benefits Engagement Year-Round: A Broker’s Role

A strong benefits package is only half the equation.

The other half? Making sure employees actually understand and use it.

Too many employers treat benefits like a once-a-year event—something that begins and ends with open enrollment. But employee engagement isn’t seasonal, and neither is your value as a broker.

If your clients only communicate benefits once a year, it’s like watering a garden in April and expecting it to bloom all summer. Engagement—consistent, clear, and personalized—is what keeps benefits alive and valuable year-round.

That’s where you come in.

The Broker’s Evolving Role: From Plan Builder to Engagement Architect

As today’s workforce expectations evolve, your role as a broker has expanded. You’re no longer just recommending plans—you’re shaping strategies that improve communication, retention, and satisfaction.

According to the Selerix Employee Benefits Survey, employees who are satisfied with their benefits are five times more likely to stay and 3.5 times more likely to trust their employer. Yet only 27% say they fully understand their benefits, and one in three admit they’ve regretted a benefits choice.

That gap between what’s offered and what’s understood is your opportunity.

Engagement isn’t just good for employees—it’s good for your business. When clients see results in utilization and retention, your partnership deepens, renewals are smoother, and referrals follow.

For more insights, see The Broker’s Guide to Recommending Benefits.

Why Year-Round Benefits Engagement Matters

A well-crafted benefits plan is like a finely tuned car—it’s built for performance. But without fuel (communication), it doesn’t get far.

Engagement gives benefits their horsepower. It transforms static offerings into living experiences that drive employee trust, productivity, and loyalty.

- 74% of employees read benefits emails, but only 51% take action when the message feels personal.

- 39% delayed care this year because they weren’t sure what their plan covered.

- And only 16% used decision-support tools during open enrollment.

These are engagement issues—not benefit design issues. The good news? Brokers are perfectly positioned to fix them.

By guiding clients to invest in continuous communication, you help them increase utilization, improve satisfaction, and protect their bottom line—all while reinforcing your value as a strategic partner.

The Broker’s Blueprint for Year-Round Engagement

From The Broker’s Guide to Recommending Benefits, here’s a simple framework to help your clients stay connected to their workforce all year long:

1. Assess the Workforce

Understand who employees are—their demographics, life stages, and communication preferences. Engagement looks different for a warehouse team than for a hybrid tech workforce.

2. Map the Message

Identify which benefits matter most. Focus your client’s communication calendar around real-life priorities—mental health in February, financial wellness in April, preventive care in May.

3. Leverage the Tech

A strong benefits administration platform should support personalized, automated communication and integrate seamlessly with payroll and carriers. No more spreadsheets and “reminder” emails that get lost in inboxes.

4. Measure and Refine

Review engagement metrics quarterly—open rates, utilization, survey feedback—to see what’s resonating. Use those insights to adjust future campaigns.

Think of it like a benefits maintenance plan: regular tune-ups keep everything running smoothly.

Technology’s Role: Making Engagement Effortless

Let’s be honest—most HR teams are already stretched thin. Between compliance deadlines, onboarding, and open enrollment prep, ongoing benefits communication often falls through the cracks.

That’s why brokers who bring technology to the table stand out. A modern benefits administration platform does more than manage enrollment; it automates the communication that keeps employees connected.

Selerix’s platform, for instance, helps brokers and clients:

- Deliver targeted, behavior-triggered messages (think reminders before deadlines).

- Educate employees with decision-support tools built right into the experience.

- Ensure compliance with ACA, COBRA, and other regulations—without extra paperwork.

The right tech doesn’t replace HR—it amplifies them. And when you make engagement simple, your clients see you not just as a broker, but as an essential business partner.

Explore how Selerix simplifies benefits administration.

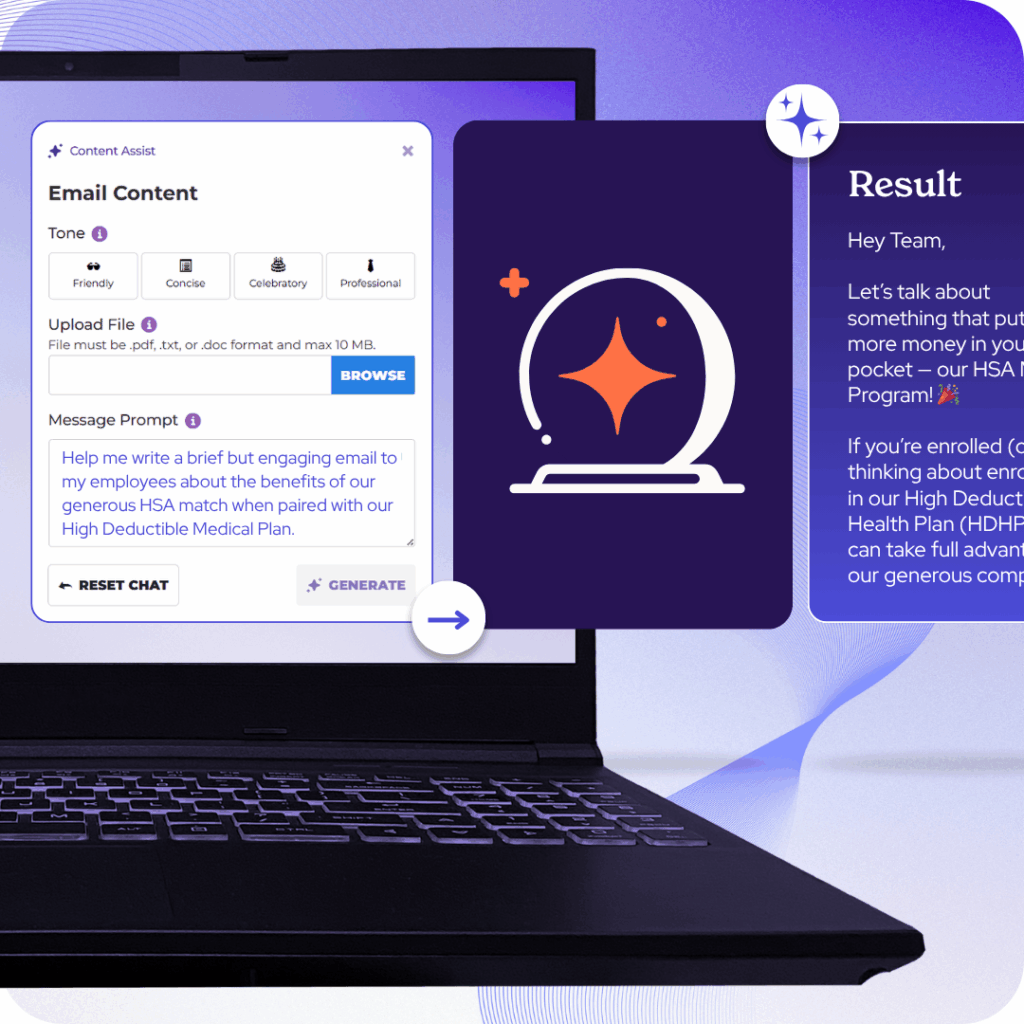

Meet Selerix Content Assist: AI for Better Benefits Communication

Even with great technology, crafting engaging, on-brand benefits messages can feel like a full-time job. HR leaders often struggle to write content that’s clear, compliant, and actually motivates employees to take action.

That’s where Selerix Content Assist comes in.

Built into our communication tools, Content Assist uses AI to help brokers and employers instantly generate professional, employee-friendly benefits content—without starting from scratch.

It can:

- Write and personalize benefits announcements in seconds.

- Tailor messages by employee type, life event, or benefits goal.

- Simplify complex language while keeping messaging accurate and on-brand.

Think of it as your client’s built-in benefits copywriter—one that never takes a lunch break.

When brokers introduce Content Assist to clients, they’re not just offering a platform—they’re offering peace of mind. It helps HR communicate smarter, faster, and with confidence.

Turning Strategy into Action

So how can brokers help clients put this into practice? Start simple, but start now.

Here’s a quick checklist to share with clients:

- Audit your current communication cadence—when’s the last time employees heard about their benefits outside open enrollment?

- Automate reminders around key dates and life events.

- Use Selerix Engage and Content Assist to send personalized messages at scale.

- Schedule quarterly check-ins with your broker (you!) to review engagement data and make adjustments.

Year-round engagement doesn’t mean more work—it means smarter work.

The ROI of Continuous Engagement

The payoff is clear. When employees understand and trust their benefits, they’re more loyal, productive, and satisfied. Employers see fewer compliance risks, less turnover, and higher morale.

And for brokers, it’s the ultimate value proposition—helping clients move from confusion to confidence with strategies that last all year.

Your clients count on you not just for what benefits to offer, but how to make those benefits work. By guiding them toward smarter technology and continuous engagement, you strengthen their results—and your own relationships.

Engagement Is the New Differentiator

A benefits plan without engagement is like a car without a steering wheel—it might look sleek, but it’s not getting far.

Brokers who lead with engagement strategies don’t just sell solutions—they shape stronger client outcomes.

With Selerix as your partner, you can simplify benefits communication, automate education, and deliver engagement that lasts all year.

Let’s make benefits work better—together.

Explore more insights on the Selerix Blog